Wealth Management

Unit Trust Savings

Unit Trust Savings

Unit trust is an investment tool through which funds from numerous different investors are pooled and managed by professional investment managers (fund managers) in accordance which predetermined investment objectives.

" To achieve the established objective, make a commitment for your future"

Unit trust savings plan is an arrangement under which an investor opens a unit trust savings account, makes regular monthly payment to purchase unit trust, and redeems/encashes all holdings upon maturity.

Advantages of unit trust savings plan:

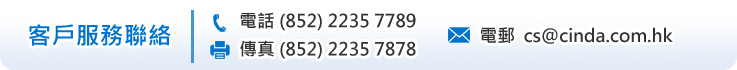

- Time Averaging

The average investment term for a unit trust savings plan is ten years or above. As illustrated in the table below, the volatility of world equity (MSCI 1969-2001) can be very high. For example, if investment time horizon is 1 year, investment return can be as high as 67.1% or as low as negative 38.0%. However, average difference between high and low narrows along time horizon. If investment time horizon is as long as 20 years, average low/high point of return can be reduced to 10.9% and 16.2%. What is interesting to note is that the average return under two scenarios is more or less the same, at about 13.5%. The return is in no way dampened by the reduction in volatility. It far exceeds inflation and bank interest rate, and the difference gets bigger and bigger though the compound interest effect.

Compound Effect

Assume $100 investment with regard to different return and number of years.

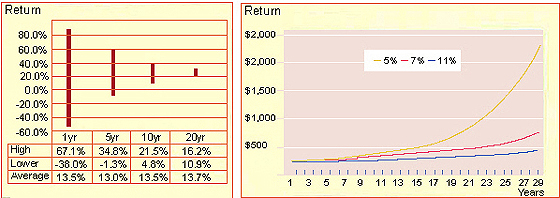

- Dollar Cost Averaging

According to the unit trust savings plan, one is making regular investment in unit trusts which can average one's cost of investment throughout the term. More units are purchased when fund price goes down and less will be purchased when price goes up. The key point is: "Buy more when price is low and buy less when price is high." The investor does not need to time the market and can keep purchase cost of unit trusts at low level.

Example 1: Up trend with corrections along the wayMonth 1 2 3 4 5 6 7 8 9 10 11 12 Monthly Saving $2,400 Unit Price $5 $6.5 $6 $7.5 $7 $8.5 $8 $9.5 $9 $10.5 $10 $11.5 Average Price $7.80 Quantity of Units 480 369 400 320 343 282 300 253 267 229 240 209 Total Units 3,692

Account Value: $11.5 x 3,692 = $42,458

Savings: 12 months x $2,400 = $28,800

Return on Investment: 47.4% profit = $13,658

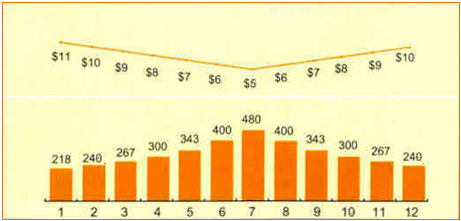

Example 2: Fall followed by stabilizationMonth 1 2 3 4 5 6 7 8 9 10 11 12 Monthly Saving $2,400 Unit Price $11 $10 $9 $8 $7 $6 $5 $6 $7 $8 $9 $10 Average Price $7.80 Quantity of Units 218 240 267 300 343 400 480 400 343 300 267 240 Total Units 3,692

- Flexibility of unit trust savings plan: