Securities

公司簡介 >

Investors can buy or sell stock options according to personal portfolio needs.

- Buy Call/Put Stock Options

Pay Premium, infinite profit/significant profit - Sell Call/Put stock options

Receive Premium, infinite loss /significant loss

| Option types | Long | Short |

| Call | Bullish | Bearish |

| Put | Bearish | Bullish |

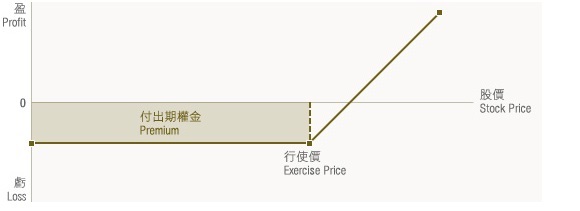

- Long Call

Bullish investors have the right to buy the underlying shares at an exercise price any time prior to the expiry date.

Profit

When the price of the underlying stock rises, there would be unlimited potential profit.

Loss

When the price of the underlying stock falls, the loss is limited to the option premium.

- Long Put

Bearish investors have the right to sell the underlying shares at an exercise price any time prior to the expiry date.

Profit

When the price of the underlying stock falls, there would be profit limited to break-even point minus stock price.

Loss

When the price of the underlying stock rises, the loss is limited to the option premium.

.jpg)

- Short Call

In the event that investors are somewhat but not overly bearish on the underlying stock, when the option is exercised, the stock should be sold at the exercise price.

Profit

Once a profit is made when the price of the underlying stock falls, the profit is limited to the option premium.

Loss

Once a loss is incurred when the price of the underlying stock rises, the loss can be unlimited.

.jpg)

- Short Put

In the event that investors are somewhat but not overly bearish on the underlying stock, when the option is exercised, the stock should be bought at the exercise price.

Profit

Once a profit is made when the price of the underlying stock rises, the profit is limited to the option premium.

Loss

Once a loss is incurred when the price of the underlying stock falls, the potential loss can be significant limited to break-even point minus stock price.