Futures

服務介紹 >

Risk Disclosure of future and option Trading

The loss of trading futures and options could be very large. Before making any transaction, you should understand the contract nature (also the provisions) and the risks you may bear. Futures and options may not be suitable for some investors. You should consider your investment experience, investment objective, financial resource and other relevant conditions to decide whether you should engage in those investments.

Futures

- A certain level of risk exists in futures trading. Due to the amount of initial margin is substantially lower than the contract notional amount, futures trading have substantial “leverage effect”. A slight market movement may require the holder to deposit large additional funds.

- Even you adopt some kinds of stop loss limit order (such as “Stop loss” or “Stop limit” order), it still incur risk since the orders may not be executed because of some kinds of market situation. Besides, the risk of different combination strategies, such as “Straddle trading” and “Spread trading” may be as high as that of long or short the same basic option position.

- No one can always predict the direction of futures market correctly, investors should assess the professionalism and psychological quality of their account executives, and track their performance records.

- Before the trading, investors should understand all commission and transaction fee items with the corresponding explanations, for they would affect investment result.

- While engaging in electronic trading activity, it is unavoidable to face risk of the online system, including hardware and/or software failure, which may affect the execution of your order, investors should understand and bear the risk.

Option Trading

- A high level of risk exists in option trading. No matter investors buy or sell options, they should understand the kinds of option they are going to trade (call or put) and also the related risks.

- Both Call and Put (“Buy” or “Sell”) options involve risks. Investors should inquire the broker companies about the details and provisions of future and option contracts, especially the related rights and responsibilities (such as under what circumstances, regarding futures, you have the responsibility to make physical delivery or cash settlement, or regarding options, the exact time the holder can exercise on the expiry date.

- Some exchanges in certain countries may allow the option buyers to delay the payment of premium, which may make the buyers’ margin less than the premium. Ultimately, the buyers should still need to bear the risk of losing all the premium and transaction cost. Upon the option is exercised or expired, the buyers have to pay the unpaid balance of the premiums.

- No one can always predict the direction of FX market correctly, investors should assess the professionalism and psychological quality of their account executives, and track their performance records.

- Before the trading, investors should understand all commission and transaction fee items with their corresponding explanations, for it would affect investment result.

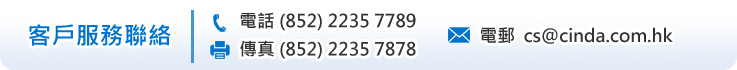

If you have any enquiries in option trading, please contact us.